There has never been a more exciting, fast-paced, and risk-fraught time to be in the business of electricity (except, perhaps, the dawn of electrification itself). A suite of disruptive technologies is rapidly altering the way electricity is produced and consumed and shifting the balance of power (no pun intended) to the edge of the grid. It isn’t just the smart grid or Internet of Things technology or distributed energy resources, but a confluence of these concepts that is shaping the electric system of tomorrow. We’re collectively calling it the Internet of Energy. No, it’s not just a nice catch-phrase for a blog series (and yes, this sounds an awful lot like Jeremy Rifkin’s Energy Internet, but we hope to dive a little deeper). The trends and technologies shaping today’s grid really do better align with the concepts of the Internet (decentralized, layered, democratized, networked) than the older, centralized paradigm of our legacy electric grid. They point toward a future power system that is more connected, responsive, distributed, intelligent, reliable, efficient, and sustainable.

For this post, we’ll review a little recent history, looking at how we got to an Internet of Energy and what the term even means.

Remember the Smart Grid?

The year 2010 was a heady time for those of us working at the edge of the grid. Concepts of a radically more efficient smart grid were in the air. With the release of the first edition of Smart Power, Peter Fox-Penner had cast a clear and compelling vision for how the grid would soon be run. Power and information would flow alongside each other and enable new demand-side opportunities. An imperative to confront climate change would drive investments in a cleaner and less centralized grid. Ratepayers would become active participants in balancing the grid, following the example of the now-famous Grid Wise pilots of the late 2000s. Thanks in large part to the Obama administration, the U.S. was investing billions in advanced metering infrastructure (AMI), a key enabler for smart grid applications. It was the most exciting thing since California tried to deregulate.

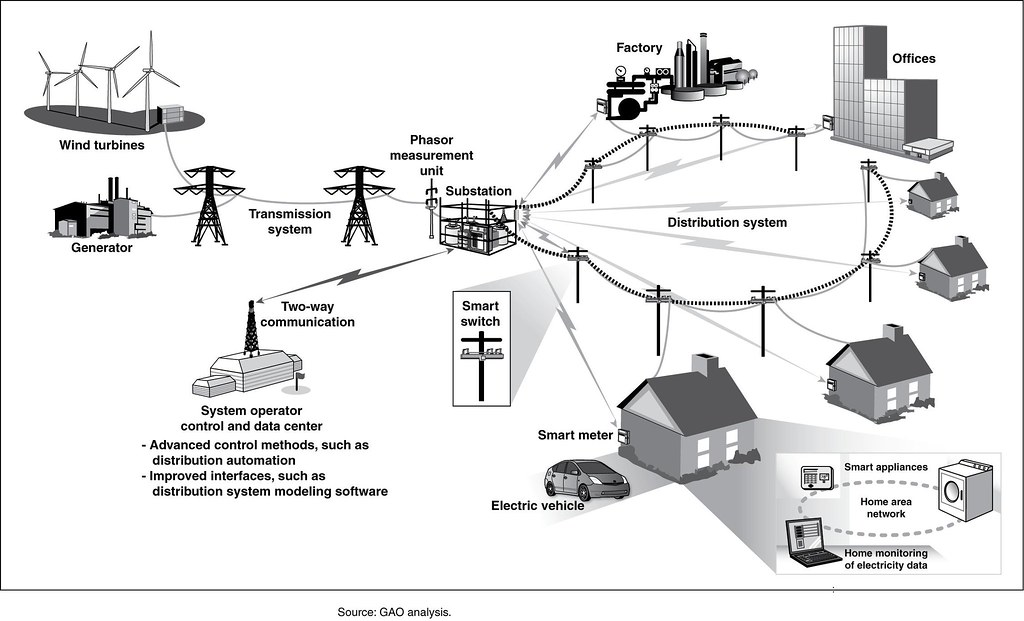

Source: GAO.

I was working (okay, a glorified intern) at Boulder-based Tendril Networks at the time, and the smart grid zeitgeist was alive and well. Tendril’s test home contained a slew of control gadgets — many developed by the company itself — including load control switches, connected outlets, smart thermostats (pre-Nest!), and in-home energy displays, not to mention an ecosystem of partner products like smart appliances and electric vehicle chargers. Tendril could emulate demand response events, and their platform would dutifully blast notifications to the home’s display devices and smart phones pleading for participation. It was slick, and it was a very faithful reproduction of the Fox-Penner smart grid vision.

Put a Pin in It

The technology to fulfill the smart grid promise was there, but it turns out the world wasn’t quite ready. The smart grid requires not just technology, but the cooperation of electric utilities, their ratepayers, and most importantly, regulators, to come to fruition. To unlock some of the most exciting services and applications of the smart grid, utilities must propose and regulators must approve new price structures that gradually expose ratepayers to more realistic grid economics. That is at once an exciting and scary proposition, and it turns out the process moves at a far more glacial pace than the technology world.

The technology to fulfill the smart grid promise was there, but it turns out the world wasn’t quite ready.The rollout of foundational smart grid technology, namely advanced metering infrastructure or AMI, is also still a work in progress depending on where you live. The Obama years saw billions of dollars in investment in utility smart grid infrastructure, particularly AMI. Some utilities and regions have fully embraced the technology, while others lag significantly behind even as recently as 2016. According to DOE’s latest numbers, many homes and businesses across the nation are still operating in the equivalent of the dial-up era.

Source: Institute for Electric Innovation

By 2011, firms like Tendril and EnergyHub soon dramatically shifted their businesses, focusing on platforms for customer engagement rather than ambitious quests for home energy management, automated demand response applications, and attempts at creating “virtual power plants” by aggregating large volumes of DR participants. Plug-in electric vehicles, which were supposed to make the customer money through daily price arbitrage, were still mere power consumers, not grid-interactive mobile power plants. It seemed that reality veered from the original smart grid vision.

Technology Catches up to the Smart Grid

Nevertheless in 2017 we have a surging market for solar, growing PV sales, growing market penetration of smart thermostats and other devices. It isn’t the smart grid we envisioned, but a melding of the smart grid, the Internet of Things, and other trends — the Internet of Energy. How did we get here?

Consumers are purchasing these products, with or without their utilities, for the same reasons they purchase anything else: they provide better service, product design, convenience, economics, and general value than traditional products. A variety of clean energy and “smart” technologies have simply evolved along paths to market that hinge less on the pace of the utility-regulatory complex and more on producing value for energy customers directly. That is not to downplay the significant role that electric utilities still play in deployment of technologies like distributed generation. Anyone trying to pass engineering review for new distributed generation knows this well. However, utilities’ cache is increasingly shared with a variety of third-party technology providers that have changed the way customers consume (and produce) energy, and those third parties have far fewer strings attached than regulated monopolies.

Take the way Nest sells its thermostats, Tesla its electric vehicles and energy storage solutions, or Vivint its PV systems. Smart control devices, EVs, and distributed generation could have all been strategic components in utility-centric smart grid programs, with utilities firmly anchored at the center of the customer relationship. But by and large, they’re not (and if the only path to market had been through utilities, chances are these entities might not have survived). Consumers are purchasing these products, with or without their utilities, for the same reasons they purchase anything else: they provide better service, product design, convenience, economics, and general value than traditional products. The fact that they save energy, reduce carbon emissions, or provide value to the grid is secondary. In the smart home sector, surveys consistently show that convenience and safety are the top purchase motivators.

What’s Next?

And so the IoE advances, with or often without utility involvement. This is not the orderly and coordinated deployment that some might have originally envisioned for the smart grid. This is an organic, distributed, consumer-driven roll-out. The utilities are often key partners in the process, but they may just as easily be left in the dark about where useful distributed resources like smart thermostats and appliances are landing. It’s a new and different game.

Questions abound.

- What are the technology trends helping to shape the Internet of Energy?

- What characteristics do the enabling technologies have in common?

- Is there such a thing as a “pure energy play” in this space?

- What are the risks and opportunities?

Curious? Subscribe to our newsletter and stay tuned as we answer these and other questions in future installments. And if you have a burning question or topic of your own, feel free to drop us a line. We’d love to hear from you.

[btn link=”http://eepurl.com/ctVb8n” target=”” size=”size-m” color=”grey”]Subscribe Me[/btn]